Yield farming with Euro stable coin - 2023

At the time of writing, the range of EURO stablecoins is rather limited when compared to their USD counterparts. The few noteworthy ones include:

- EURT, issued by Tether.

- EURS, issued by Stasis.

- EUROC, issued by Circle.

- agEUR, a collateralized stablecoin by Angle Protocol.

For those interested in yield farming with EURO, there are several viable options:

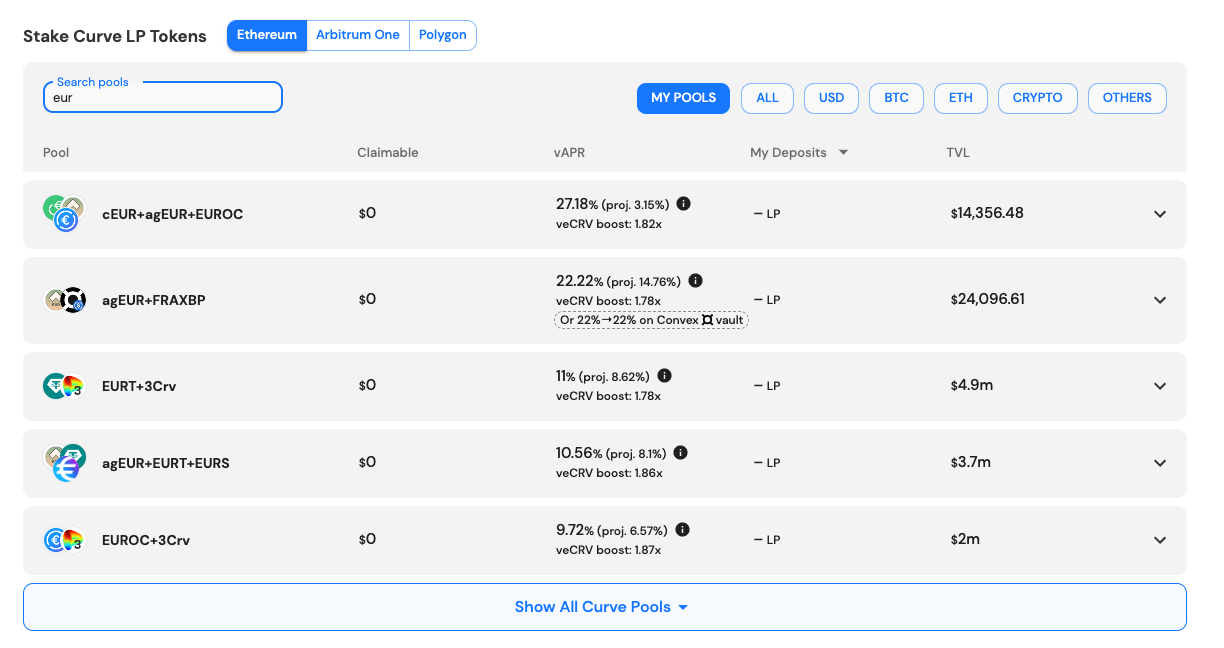

Convex in Collaboration with Curve

Curve hosts several pools supporting USDC-EURO pairs, as well as pure Euro pairings such as AGEUR-EUROC. The current yield rate (including rewards) for these pools is approximately ~9%.

Explore these opportunities on Convex.

Single-Sided Lending

Aave v3 on Polygon supports two Euro stablecoins: EURS and AGEUR. Although the yield rate is relatively low at ~1%, it’s noteworthy that you can use EURO as collateral to borrow additional assets for yield farming on Aave.

Final Thoughts

As always, ensure to conduct your own due diligence before making any decisions. Stablecoins come with their own set of risks, including regulatory risks and smart contract vulnerabilities.