What is backing DAI?

DAI is the largest decentralized stablecoin by market cap. To assess the risks of extreme events, it is important to understand its collateralization.

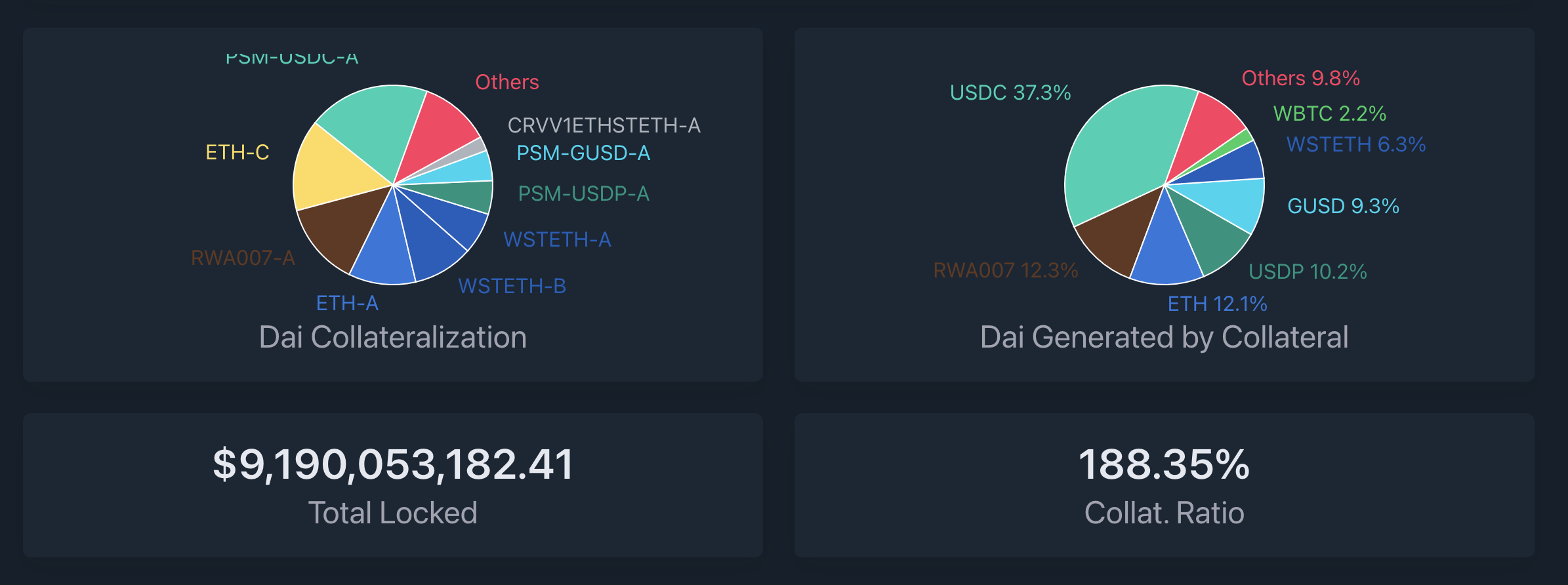

DAI Stats

DAI Stats provides information on the current backing of DAI.

To fully grasp the details, we need to differentiate between “Dai Collateralization” and “Dai Generated by Collateral.”

Dai Collateralization

Each DAI is generated through an over-collateralized vault, and each type of vault has a different collateralization ratio. This means that for various types of backing or interest rates, the excess amount of cryptocurrency differs.

This chart displays the assets backing DAI and their distribution by value.

Dai Generated by Collateral

Each DAI is generated from different vaults. This chart shows the composition of DAI generated from various vaults. For example, if there are 2 DAI in total, with one generated from ETH and the other from USDC, the composition would be 50% ETH and 50% USDC.

How to Use This Information

Another crucial metric is the overall collateralization ratio, which currently stands at 188.38%. This means that a single DAI ($1) is backed by approximately $1.88 worth of assets. If all USDC were to be blacklisted by Circle and rendered worthless, the collateral value would drop to 1.88 * (100% - 19.8%) = 1.5. There would still be some buffer room if one type of collateral were to collapse. However, the situation might be different for USDC, given the design of the PSM (Peg Stability Module) and the high minting cap, which we will discuss in another article.