Compound v3 Yield Farming Strategy 2023 - Polygon

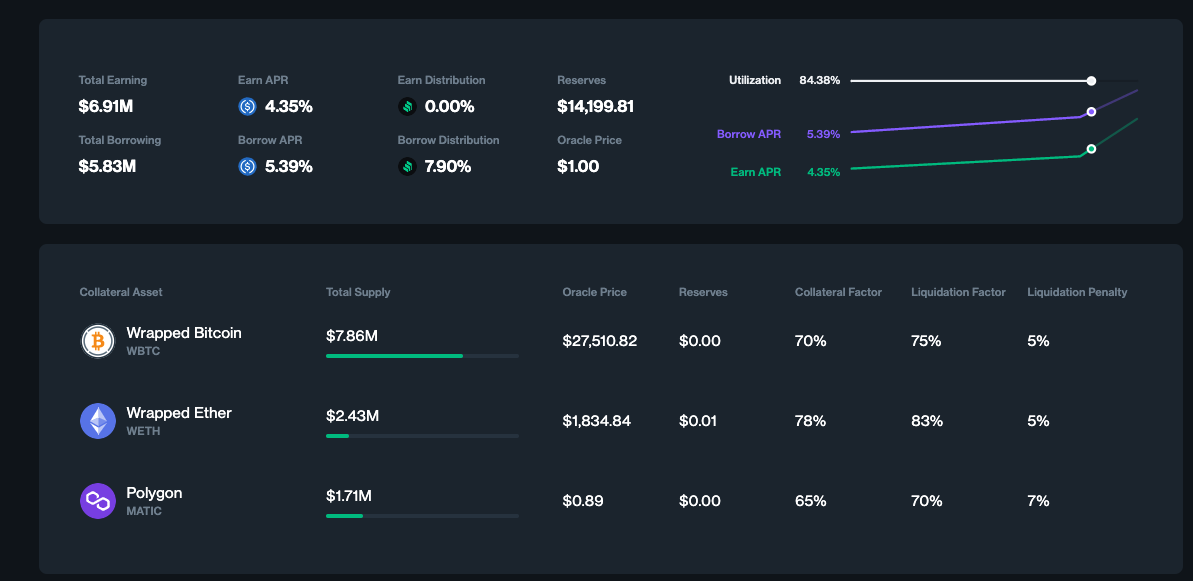

Compound recently launched its v3 application on the Polygon network, introducing new farming opportunities. The only market currently available on the Polygon network is the USDC market, which allows users to deposit crypto in order to borrow USDC.

To leverage these farming opportunities, follow these steps:

- Deposit WBTC, ETH, or MATIC into the protocol.

- Borrow at the current rate of 5.39%.

- Receive payments in $COMP at 7.9% of the borrowed amount.

- Unlike Compound v2, “folding” is not an option in v3. With the borrowed USDC, you can either deposit it back into Compound v3 (using a different wallet) or seek another yield source for USDC to offset the borrowing cost.

What Yield Can I Expect?

Ether currently has the highest collateral factor at 78%. Assuming a deposit of $100 worth of Ether, you could borrow up to $78 of USDC. However, to minimize risk, let’s consider borrowing only $50 of USDC and depositing it back for lending. In this scenario, the final yield would be:

$50 * (7.89% - 5.39% + 4.35%) / $100 = 3.425%

This simple example demonstrates the potential for earning through farming on the Compound v3 platform on the Polygon network.